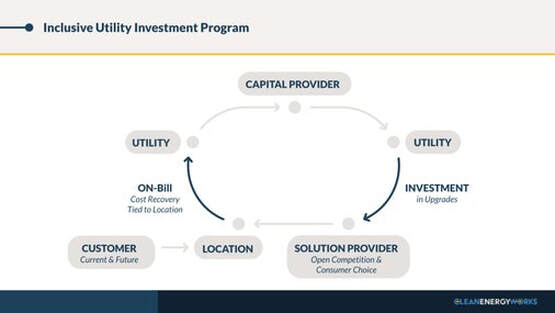

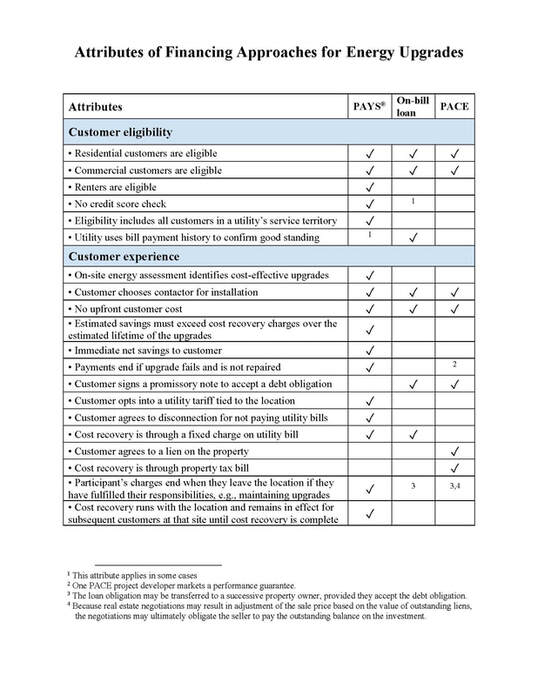

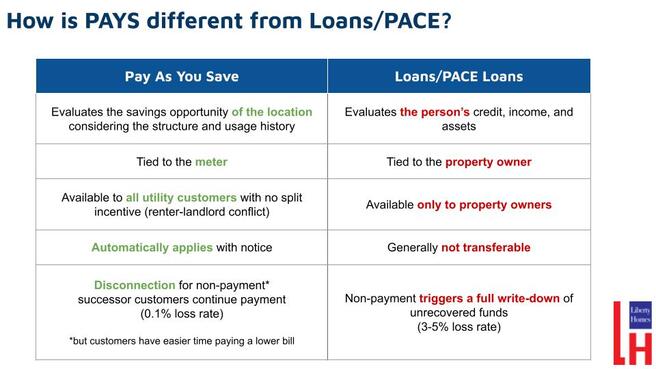

by Daniel BakerA Better Way to Finance Clean Energy: Inclusive Utility Investment (IUI) Energy efficiency plans must be inclusive, or they risk missing crucial pieces of the puzzle; from individuals to GHG-emitting buildings. In December 2021, we outlined the shortcomings of debt-based solutions to expanding energy efficiency in buildings. Today, we are explaining the vast benefits of a superior method: Inclusive Utility Investment (IUI). Inclusive Utility Investment, in its simplest form, IUI refers to a financing method for energy efficiency which eliminates the primary barriers most people face with, even the most lenient loan programs such as PACE & C-PACE. The utility, private or public, pays for energy efficiency upgrades. It is important to note that any company, organization, or individual could finance energy efficiency upgrades, but when utilities take the lead, they directly invest in decarbonization efforts. How It Works Inclusive Utility Investment removes the upfront cost to customers by tapping into the borrowing power of capital rich utilities – entities that can secure even more money for installing upgrades through low- to zero-interest loans from the government. Inclusive Utility Investment does not factor an individual’s income or credit scores into the assessment of energy efficiency upgrades; only the savings potential dictates the outcome. Inclusive Utility Investment removes payback uncertainty associated with traditional loans from the lender’s point of view. Inclusive programs allow energy efficiency programs to benefit everyone. Investor-Owned Utilities (IOUs) are set to spend $140 billion on capital investments between 2021-2023. The key question is: will those resources be spent equitably? Common Misconceptions On-Bill programs are the same as Tariff-On Bill programs. On-bill simply means that the customer pays back what they owe via their utility bill. TOB programs, such as Pay as You Save® (PAYS®) incorporate a predetermined limit on how much of a customer’s energy savings go toward reimbursement versus how much goes back into their pocket. The PAYS® program was developed by the Energy Efficiency Institute, Inc. The payback process, and equity benefit, is explained in more detail below: “The cost-recovery charge on a customer’s bill is substantially less than the estimated savings generated by the upgrade, so the customer enjoys immediate positive cash flow.” The U.S. Department of Energy stressed the difference between traditional on-bill loans and tariff on-bill model in a 2019 brief (emphasis our own): “The on-bill tariff model differs from on-bill loans and repayment models in that tariffs are not a loan, but rather a utility expenditure for which cost recovery is tied to the utility meter according to terms set forth in a utility tariff.” Same Consumer Protection under PACE as PAYS®: Remember, there is almost no risk to the customer under PAYS®. If the customer leaves or a new renter moves in, the utility continues to receive reimbursement so long as the building uses electricity. This means that building owners who move do not have to carry a burden for energy efficiency upgrades that they no longer benefit from and renters are free to enter or exit a lease, while still receiving those benefits. Now if one does not pay their utility bill, the penalty is no longer compounded with loan fees; it is the same as any failure to pay a utility bill, which may result in a disconnection. Again, it is important to note that bills are typically reduced under tariff on-bill programs, making energy bills more affordable. Inclusive Utility Investment projects are more likely to be cash-flow positive, with projected savings exceeding any costs, further protecting low-income participants from incurring additional monthly expenses. Inclusive Utility Investment Programs Lead to Greater Equity Customers with high energy burdens are often left in the dark. Low-income households and businesses lack the resources to invest in energy efficiency which is a long-term solution to keeping their utility bills affordable. “Unlike loan or rebate programs, a PAYS program allows a utility to deliver a range of energy services to hard-to-reach customers including rental, rural, and LMI populations.” Here is the kicker, as explained by Holmes Hummel, PhD of Clean Energy Works: Utility Commissioners have the power and authority to move forward with Inclusive Utility Investment programs like PAYS® right now! They don’t need to wait for additional approval. Gemini Pursues Inclusive Financing Programs By investing directly into the property itself, utilities’ capital, and their access to low-rate capital, can help alleviate decades of systemic inequities. Gemini pursues Inclusive Utility Investment financing as an option wherever possible and is working with Roanoke Electric Cooperative in North Carolina to upgrade commercial buildings through that tool. When that option is not available, Gemini connects customers with zero-to-low interest loans. While not a perfect solution, Gemini further protects its customers by performing the energy audit, and not implementing the upgrades themselves. If an energy efficiency or electrification upgrade is not net-positive for you, we are not going to recommend it. About the author: Daniel Baker

Ten years of journalism and digital communications experience. In the previous ten years, Daniel has assisted in the first-ever launch of a new channel on a major radio network. By starting two podcasts from scratch, he helped launch the flagship chat show on a national digital TV network. Daniel also came up with pitches, wrote both short and long pieces, and edited them for a digital magazine. He managed marketing and communications for a successful outdoor recreation company that significantly relies on the environment for many years. It's safe to say that Daniel has accumulated a tremendous amount of experience operating under pressure and in a quick-paced setting. He is a skilled multi-tasker and project manager due to his experience producing national broadcasts and managing seven tasks at once! It would be difficult to find someone who is more adept at managing several tasks at once. His success has been largely attributed to his attention to detail. Each show is the result of hours of research. Sharing is caring. Share this blog with your network!

1 Comment

I like that you pointed out that utilities can aid ith decarbonization effects when they invest in energy-efficiency upgrades. I hope that this is done in our area so that we can save money in the long run. It might convince them to do so if all of the residents and commercial property owners get a utility bill audit and make them realize the usage and the costs.

Reply

Leave a Reply. |

Archives

April 2024

CategoriesStart reading our blog today. Enlighten is good for your soul. Get updates, advice from energy experts and much more. You will not be disappointed. Find out everything you need to know about clean energy hubs, energy audits and much, much more. Grab a cup of coffee sit back and relax as you start reading our blog. Thak you for stopping by..

|

|

Partners

|

Company

|

|

RSS Feed

RSS Feed